Get the free employer ein form

Get, Create, Make and Sign

Editing employer ein online

How to fill out employer ein form

Who needs an Employer Identification Number (EIN)?

Video instructions and help with filling out and completing employer ein

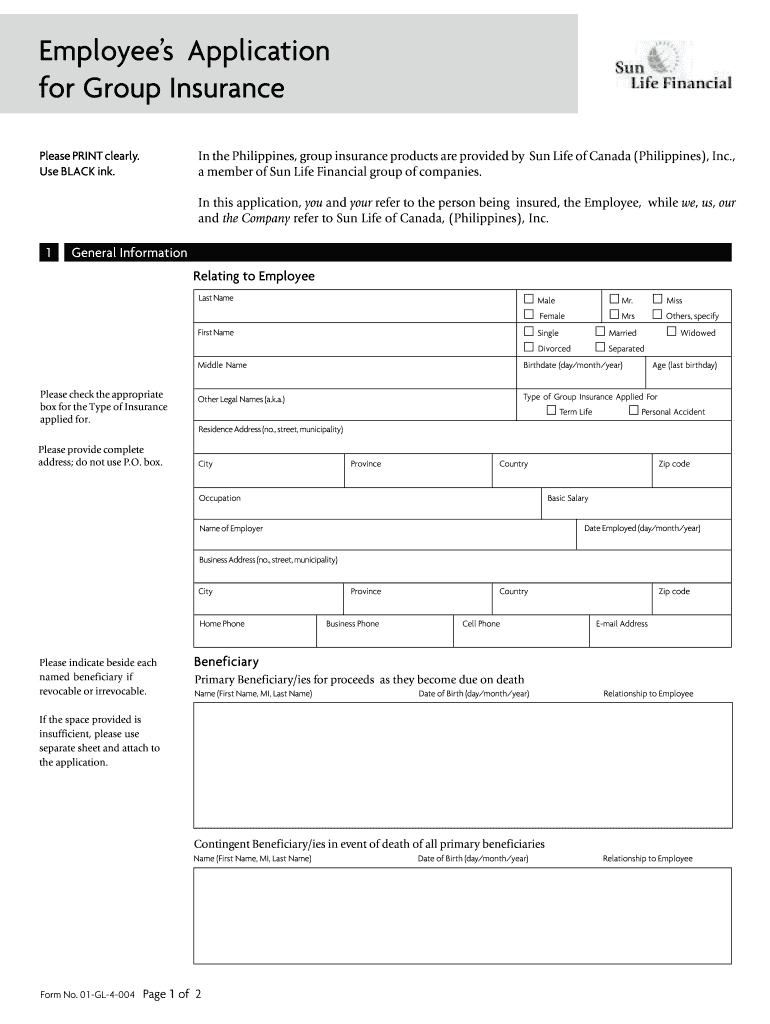

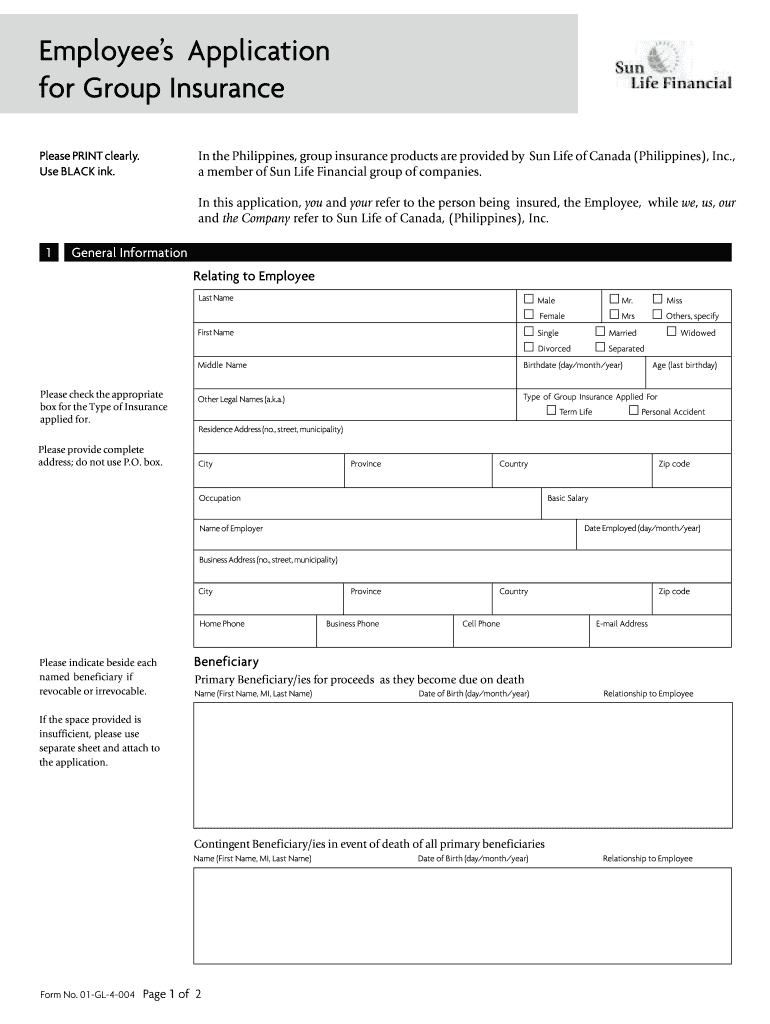

Instructions and Help about form gl 4

Hello everybody Josh Nor dine here with another exciting YouTube tutorial for commercial Accord forms, so today we're going to look at the Accord 137 now this is the commercial auto form it's actually one of two forms needed to do a commercial auto quote all Accord forms need the 125 which explains you know the insured and their location and that sort of thing the Accord 127 which I'm going to have a video on that here as well that is going to show the VIN information for the vehicles, and you know listing out all the scheduled autos and that sort of thing, but today we're looking at the chord 137 now this is explaining what is covered or how it is covered I should say and the coverage is involved so let's go ahead and get started and by the way remember um there are more videos on my page, and I'll always be releasing new ones as well as insurance agency best practices so feel free to subscribe alright let's start with the date and let's just use today's date here what is today's date oh man already getting that time of year okay always make sure to put your agency name if you can because stuff gets lost in underwriter emails, so it's just good to have that up there now we always want to use the named insurance entity so in this case we're going to say Joe's HVAC Inc there's usually like a doing business as, or sometimes it's known as Joe's plumbing or something, but we want to use the actual entity name and if you want to list the doing business as you can now we're going to skip this information policy number carrier niece code we're only going to answer the stuff that's required for a quote today because what producer wants to fill out more than they have to that's pretty rhetorical okay so let's use the effective date as the first actually underwriters are going to hate me if I do that let's go ahead and say the 31st like every good agent I always quote my stuff about 30 to 90 days in advance just kidding we know how that goes okay everything below this section here like these numbers for example liability met payments and all this we're going to use the key down at the bottom, so I'm going to go ahead and just addition the page so that we can see everything here so down here you see the covered Auto symbols these are we're gonna use primarily one two six and seven so let's just look at each one of these real quick because it'll make everything else easy so covered Auto symbol one that is any Auto, and it's just like it sounds any auto whether it's owned or not owned or yours or theirs owned autos only are autos that the business owns and any time you think of owned or non-owned we're thinking about what the business owns okay with the entity owns and then six is owned autos subject to compulsory uninsured motorists law and then seven are specifically described autos remember I mentioned that Accord 127 that's where we're gonna specifically described autos and lists the VIN's alright so let's go take a look at the top here we've got...

Fill 01gl4 004 application : Try Risk Free

People Also Ask about employer ein

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your employer ein form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.